There is no denying the fact that insurance is a complex matter. Trying to understand all the exclusions, the terms and conditions of the policy as well as the deductibles in depth can take years. Here are the top basic components of business insurance for anyone wishing to start their own business.

There is no denying the fact that insurance is a complex matter. Trying to understand all the exclusions, the terms and conditions of the policy as well as the deductibles in depth can take years. Here are the top basic components of business insurance for anyone wishing to start their own business.

- The physical building that the business is located in must be insured. If the building is leased, the landlord may be responsible for insuring it. All the machinery, office equipment, raw materials, furniture and personal property should also be included in the policy.

- If the business deals with public, it is imperative to get a policy that covers any losses to others due to negligence. This will ensure that personal injury or property damage that may be caused by the business owner is compensated by the insurer.

- Most businesses hire employees and therefore, worker’s compensation insurance will be required. Employers should also take into account health insurance and life insurance for their employees. Although life insurance is optional, worker’s compensation is mandatory.

- The bloodstream of any business is its profits. If the income stops, the business will more than likely go bankrupt. This is when business interruption coverage will come in handy for replacement of lost earnings.

Much like the mid-western states, here in Arizona, we also have tornadoes…..but just in a much, much smaller size. We like to call them dust devils. Others may have their own names for them, such as whirlwinds or wind funnels. Just like tornadoes, dust devils are a weather phenomenon of a vertically column of rotating air. But unlike tornadoes, dust devils aren’t backed by a larger force such as a mesocyclone from a thunderstorm.

Much like the mid-western states, here in Arizona, we also have tornadoes…..but just in a much, much smaller size. We like to call them dust devils. Others may have their own names for them, such as whirlwinds or wind funnels. Just like tornadoes, dust devils are a weather phenomenon of a vertically column of rotating air. But unlike tornadoes, dust devils aren’t backed by a larger force such as a mesocyclone from a thunderstorm. Here’s a little social proof for you that the Empower Network is making a huge financial difference in more than just my life. Here’s an amazing story directly from the Facebook profile of a guy on my team named Kutako.

Here’s a little social proof for you that the Empower Network is making a huge financial difference in more than just my life. Here’s an amazing story directly from the Facebook profile of a guy on my team named Kutako. Some may think that a struggling economy has made things nearly impossible for salespeople across the country, but with the ability to now use sales software and liveware right at your fingertips and increase your sales without leaving your home, things have never been easier. There are many different platforms in which you can help build on your craft, and here are a few of the programs that will drive your sales.

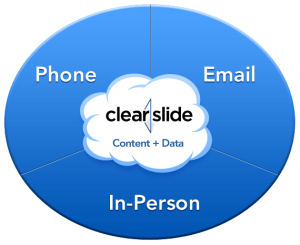

Some may think that a struggling economy has made things nearly impossible for salespeople across the country, but with the ability to now use sales software and liveware right at your fingertips and increase your sales without leaving your home, things have never been easier. There are many different platforms in which you can help build on your craft, and here are a few of the programs that will drive your sales. My very first Entrepreneur experience as a kid was selling a very special product….a product you’d expect to see from two boys. With as abundant as they were, we couldn’t let the opportunity to sell night crawlers pass us by! Yup, we sold worms to local fisherman, and not just any worms, the big ones! These were the type of worms that could pull a six year old kid right into the ground.

My very first Entrepreneur experience as a kid was selling a very special product….a product you’d expect to see from two boys. With as abundant as they were, we couldn’t let the opportunity to sell night crawlers pass us by! Yup, we sold worms to local fisherman, and not just any worms, the big ones! These were the type of worms that could pull a six year old kid right into the ground.